Contemporary art as a strategic

asset

Matis offers exclusive access to investment opportunities in 19th and 20th-century artworks, curated by our team of specialists.

Discover our

track-record

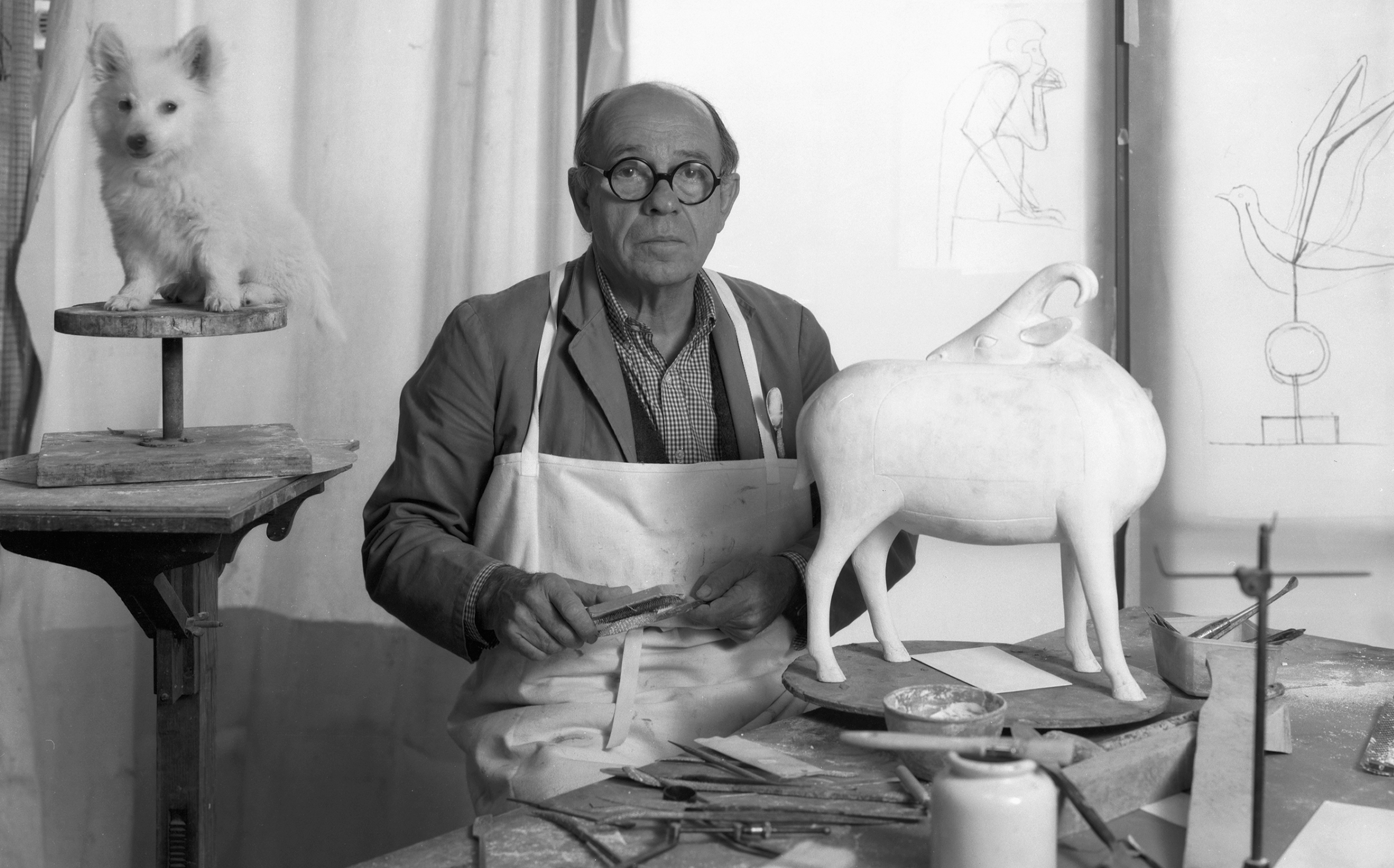

François-Xavier

Lalanne

7,87%

NET INVESTOR PERFORMANCE

7,04%

HOLDING PERIOD

10 months and 22 days

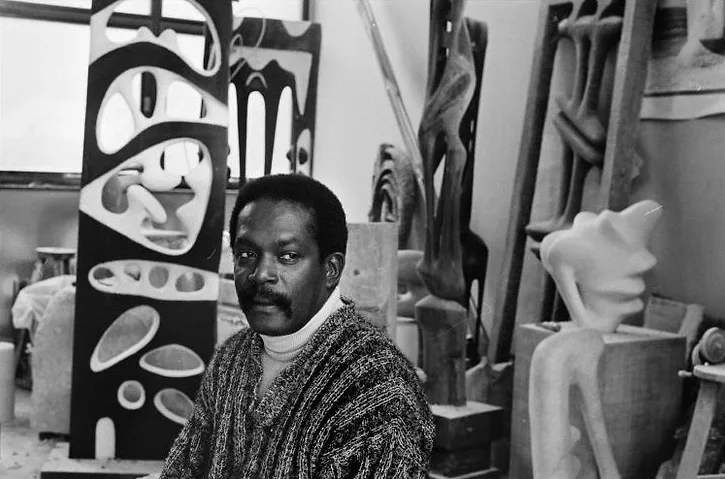

Agustín

Cárdenas

15,88%

NET INVESTOR PERFORMANCE

20,41%

HOLDING PERIOD

15 months and 4 days

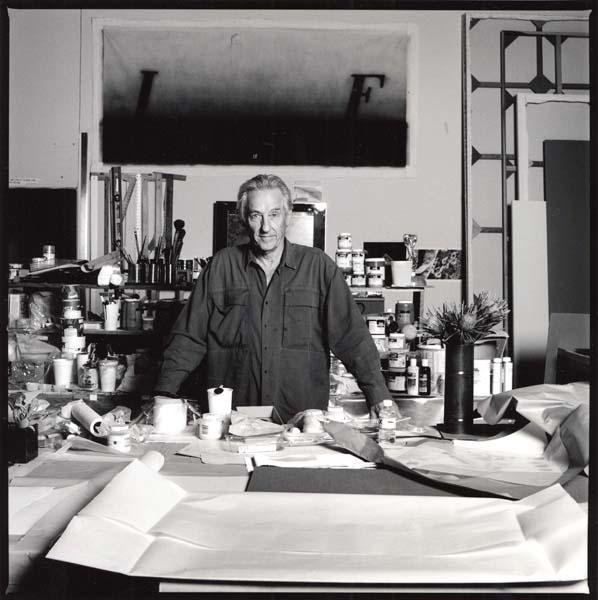

Ed

Ruscha

10,38%

NET INVESTOR PERFORMANCE

18,40%

HOLDING PERIOD

20 months and 15 days

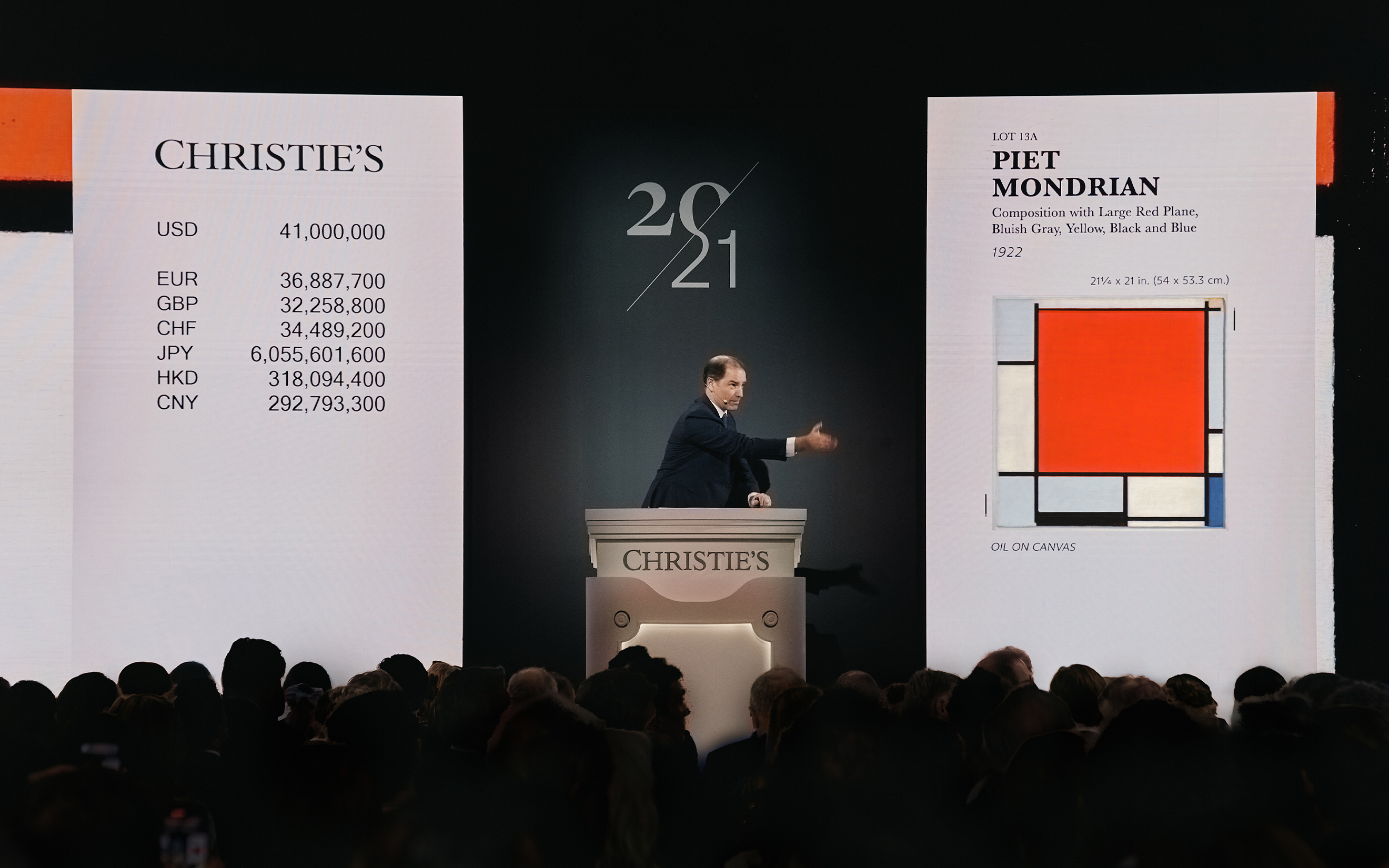

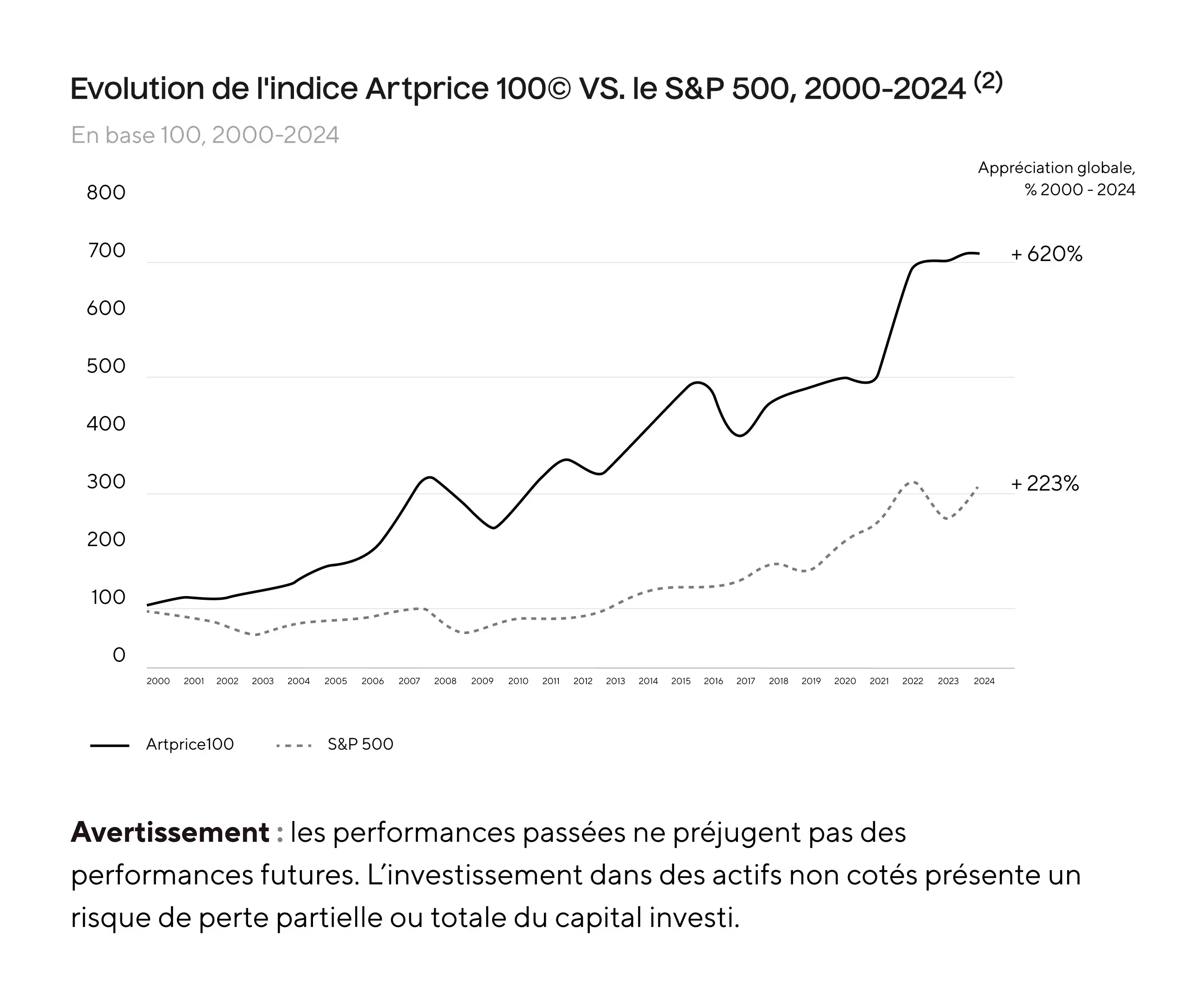

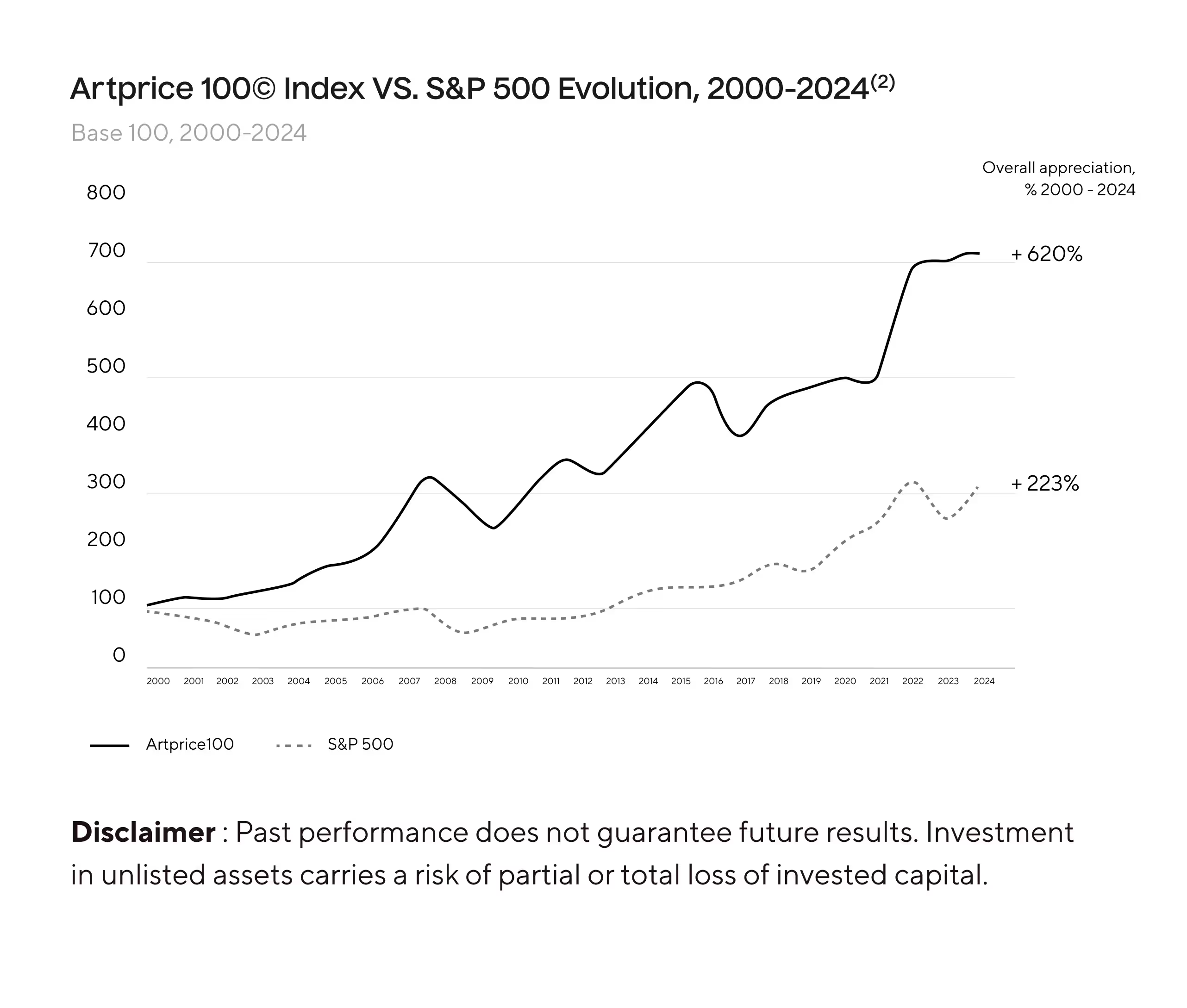

Blue chip art(1) as a new asset class

Easily access investment in the art market

We select artworks from major artists

Our team of specialists identifies trends in the markets for iconic, renowned, and established artists on the international market. Their works, which are featured in major museums, regularly sold at auction, and sought after by collectors, are identified at the best possible price.

We present these investment opportunities starting at €20,000

For each selected artwork, a project company is structured to allow investment through the subscription of convertible bonds into shares.

We entrust the artworks to leading global galleries for resale

Once financed, the artwork is given to a network of galleries specializing in the specific artist, capable of presenting it to the proper collector at its market value. Investors regain their investment as well as any realized capital gains (not guaranteed) after the artwork is resold.

Matis is the result of a strategic partnership between experts

in art and finance

%20Julien%20Mouffron-Gardner-00939%20(1).webp)

Arnaud Dubois

Teacher of private fine art asset management at Paris-Panthéon-Assas

%20Julien%20Mouffron-Gardner-00939%20(1).webp)

Arnaud

Dubois

Teacher of private fine art asset management at Paris-Panthéon-Assas

%20Julien%20Mouffron-Gardner-00404%20(1).webp)

François Carbone

President of the French Crowdfunding Federation

Forbes 30s under 30

%20Julien%20Mouffron-Gardner-00404%20(1).webp)

François Carbone

President of the French Crowdfunding Federation

Forbes 30 Under 30

As the creator and head of the sector's association until 2014, he also played a crucial role in the creation of French crowdfunding regulations.

Easily track your investments

Our investment platform has been designed to allow you to invest entirely online.

Discover currently open investment offers ;

Sign your subscription agreement ;

Keep up to date on the status of your investment until it is resold ;

Matis opens the doors of the art market for you

Beyond investment, we offer you an exclusive cultural experience.

Let our investors speak for us

Start to diversify your investment portfolio

Matis works with wealth management professionals

.png)

.webp)

.svg)

.jpg)