Matis opens the

doors of the art market for you

Our team of professionals makes it possible for you to invest in a world of opportunities without constraints.

Our observation

Buying iconic works of art directly requires expertise and networks in a market where information is asymmetric.

It requires significant cash flow, expertise in assessing the work, its condition, and its provenance, organizing its transport, and insuring it throughout its lifetime.

Once all these steps have been completed, finding a future buyer can be complex, requiring access to and a good knowledge of gallery and dealer networks.

Our solution

Our team selects investment opportunities and takes direct responsibility for due diligence on the artwork (condition, certificate, provenance) as well as its transport and insurance.

Thanks to Matis' investment projects, it is possible to invest in several works by major 19th and 20th-century artists.

From the selection phase onwards, we work with leading galleries specializing in the artists purchased to entrust them with the works for resale.

Your investment

experience

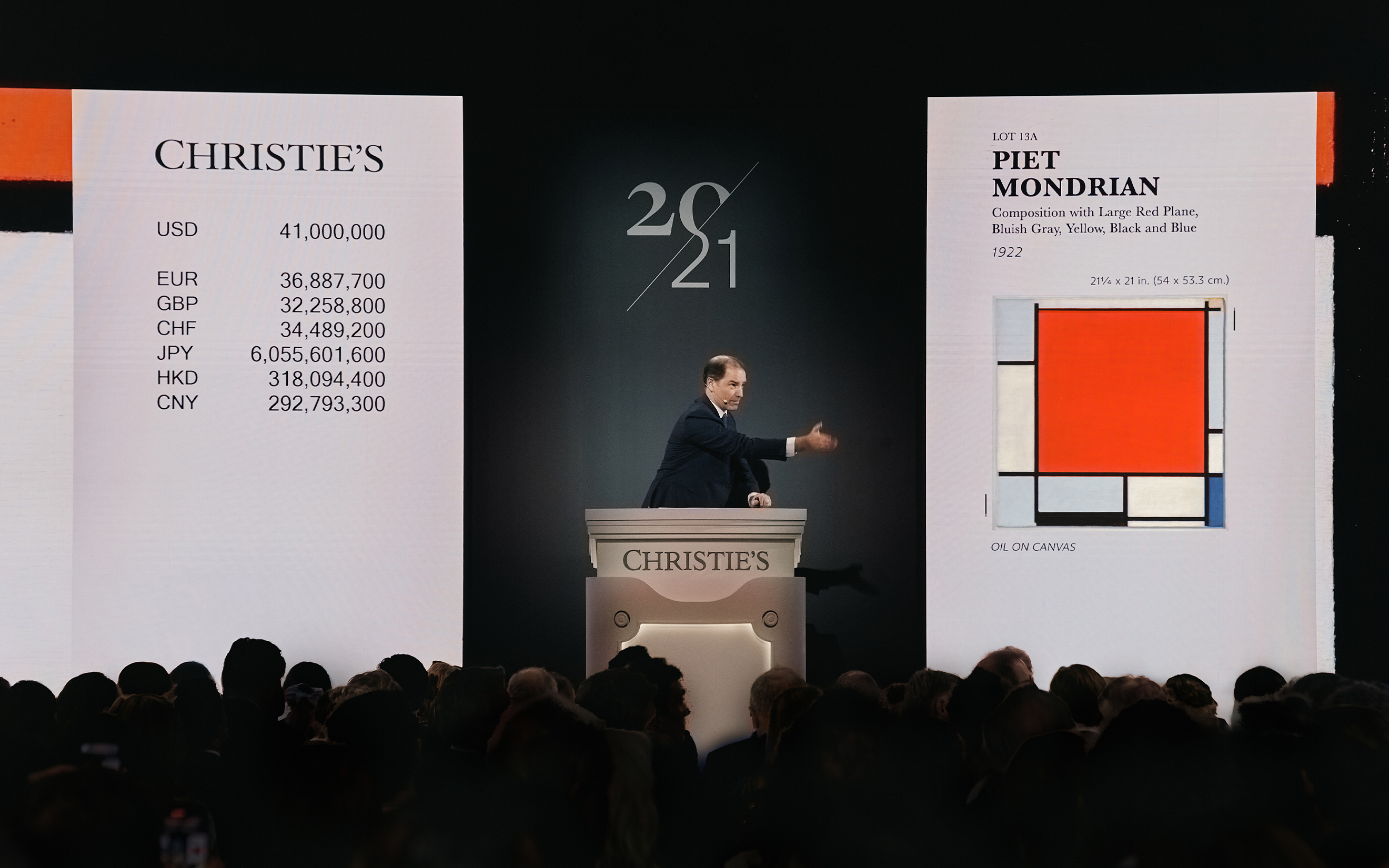

Matis Identifies Strong Art Market Trends

By analyzing market research and public and private transactions involving artworks, Matis identifies major current and future trends in the art market and pinpoints investment opportunities. Artists such as Warhol, Basquiat, and Kusama stand the test of time. Their available works are dwindling and demand for them is increasing, creating an effect of scarcity.

Matis Selects Major Artworks

The artworks selected by Matis are appreciated by museums, leading worldwide galleries, and foreign collectors, with acquisition prices ranging from 500,000 to 5,000,000 dollars. Our team has the expertise to swiftly determine the optimal purchase price, enabling us to structure diverse transactions aimed at maximizing resale value from the moment of acquisition. Because of our experience, we can acquire at a low enough price to resale through art market specialists (galleries) who are most familiar with prospective customers.

Matis offers investment opportunities starting at €20,000

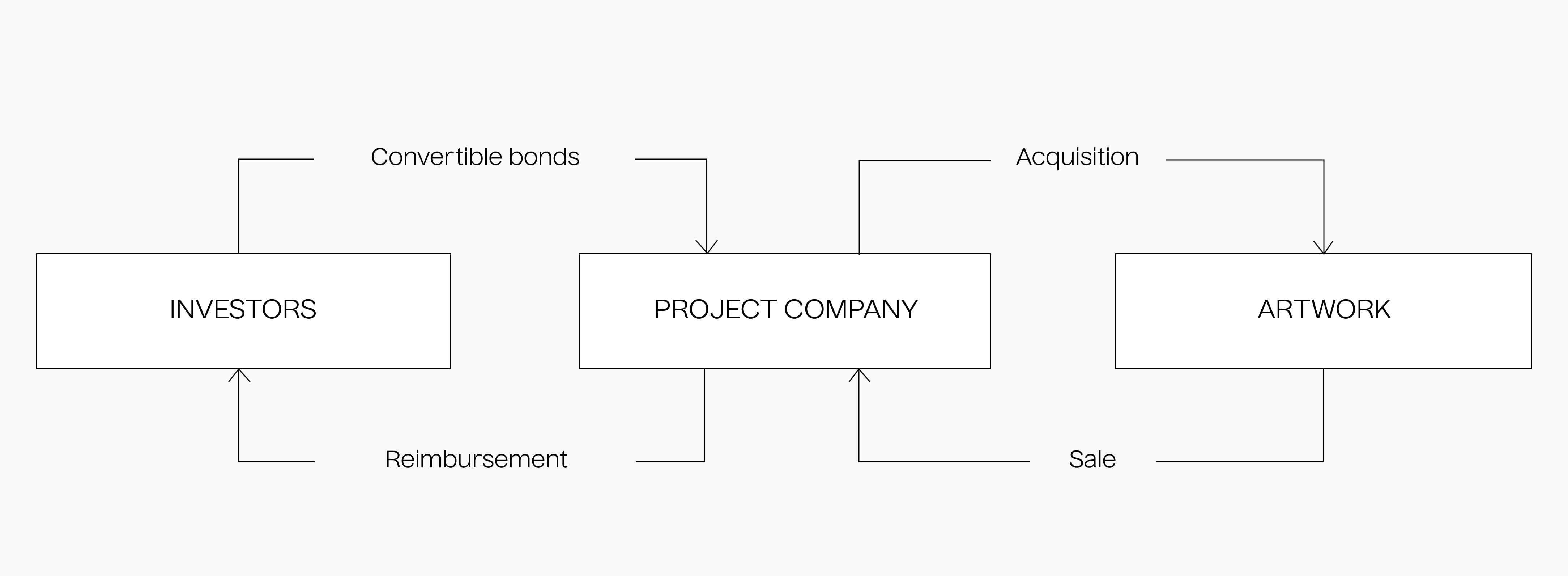

For each artwork, a project company is created in which private investors can invest through the acquisition of convertible bonds.

Artworks Are Strategically Consigned to Top-Tier Galleries to Maximize Resale Value

Matis delegates the re-sale of the artworks to art galleries specializing in their respective artists, capable of replacing the artwork in front of the right collector at its correct market value.

Matis collaborates with the largest art galleries in Europe, the United States, the Middle East, and Asia.

Upon the sale of theartwork, you recover the invested amounts along with any capital gains (not guaranteed)

Matis targets the resale of each artwork within a 24-month period. Investors are entitled to the net returns generated—after deduction of Matis’s fees—with an anticipated, though not guaranteed, IRR(1) comprised between 15% and 20%.

Easily access to the most prestigious art investment offers

What is co-investment ?

A collective investment structure, where individual investors combine resources to fund a variety of projects (stock market, real estate, art, and more.)

It offers access to high-value opportunities that might otherwise be out of reach due to limited networks, expertise, or capital.

Investing within modern and contemporary art

In the context of art, a legal structure is established to manage the investment in a specific artwork. Investors assume the role of bondholders, providing the capital necessary for the acquisition of the artwork.

Returns from this transaction are based on the capital gains realized upon its eventual resale.

Legal status and

co-investment

For each investment offer, a vehicle is created, enabling participation in a share of the artwork through the acquisition of convertible bonds.

Easily track your investments

Our investment platform has been designed to allow you to invest entirely online.

Discover currently open investment offers ;

Sign your subscription agreement ;

Keep up to date on the status of your investment until it is resold ;

Matis holds a certificate

from the AMF

Let our investors speak for us

Examples of exits

operated

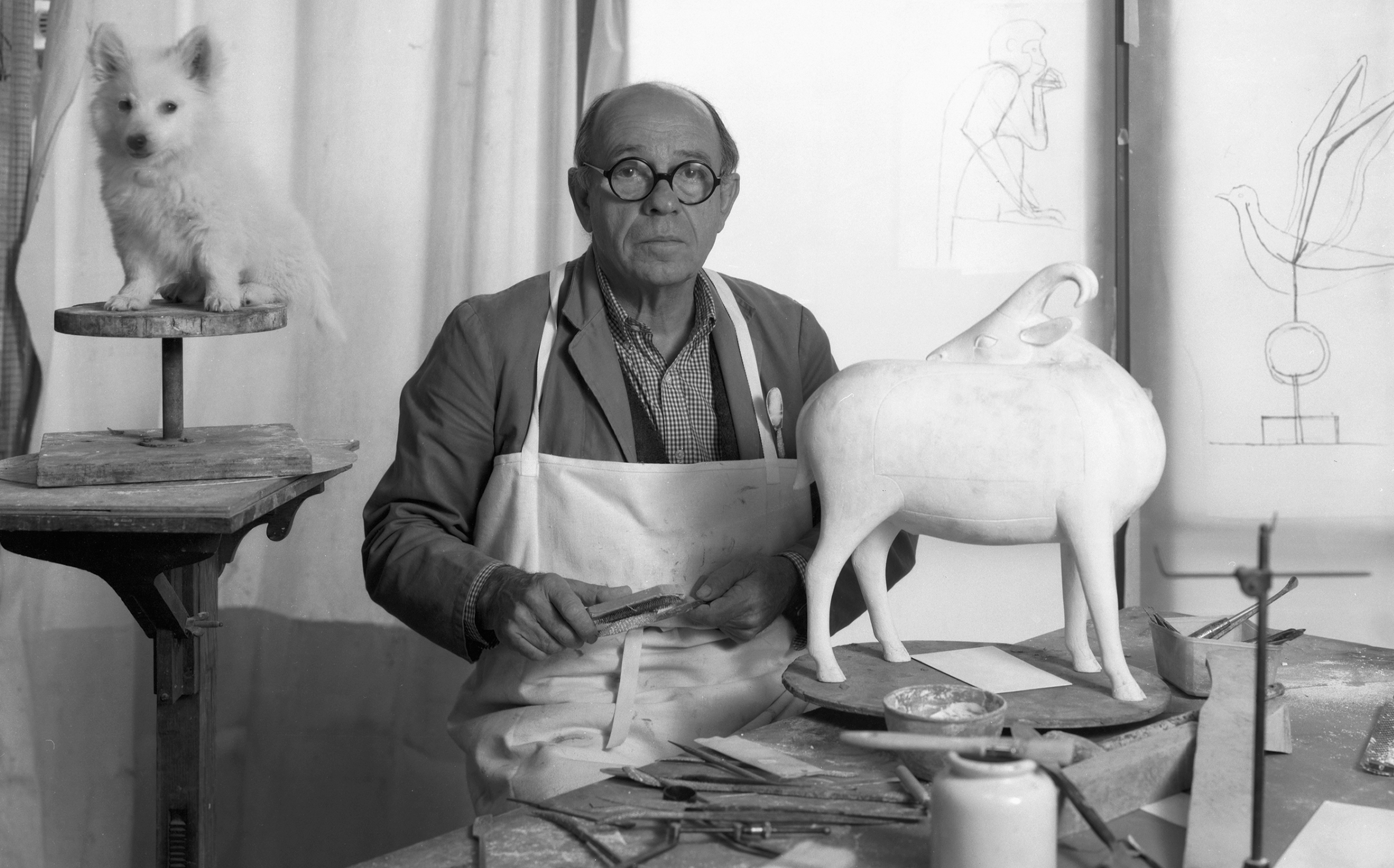

François-Xavier

Lalanne

7,87%

NET INVESTOR PERFORMANCE

7,04%

HOLDING PERIOD

10 months and 22 days

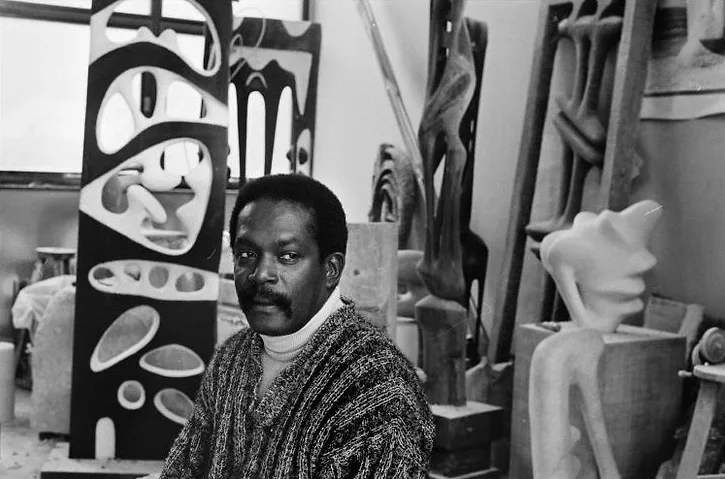

Agustín

Cárdenas

15,88%

NET INVESTOR PERFORMANCE

20,41%

HOLDING PERIOD

15 months and 4 days

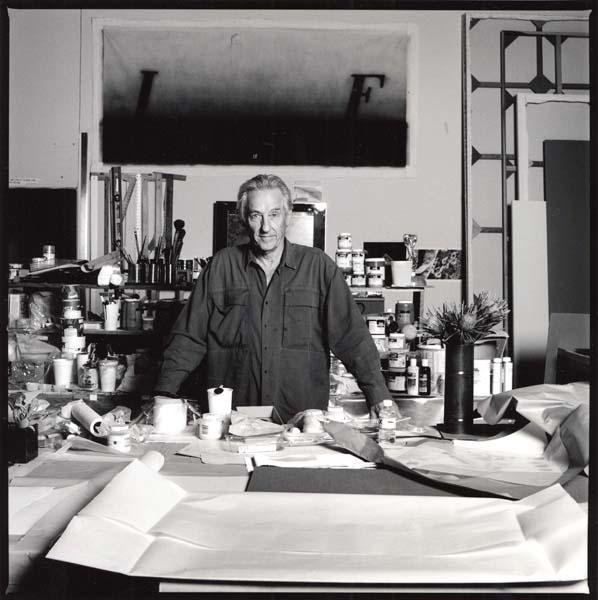

Ed

Ruscha

10,38%

NET INVESTOR PERFORMANCE

18,40%

HOLDING PERIOD

20 months and 15 days

Matis works with wealth management professionals

Questions

& Answers

Une offre d’investissement est un mode de financement collectif où plusieurs investisseurs privés lèvent des fonds en vue de financer un projet de grande ampleur. Il peut s’agir d’une opération boursière, immobilière ou encore artistique. Appliquée à l’art, l’offre d’investissement est spécifique à une oeuvre donnée, et s’appuie sur une structure juridique dédiée. L’investissement peut se traduire par l’acquisition d’actions ou d’obligations. Dans le cas de Matis, les instruments utilisés sont des obligations convertibles en action. Les investisseurs peuvent réaliser une plus-value (non garantie) à la revente de l’oeuvre, dans un horizon cible de 2 ans.

To invest in a Matis investment offer, you must create an account on the investment space app.matis.club by following this procedure:

- If you have a referral code: enter the code directly on this page and follow the different steps;

- If you do not have a referral code: complete this entry form on this page to obtain a referral code.

After your registration, an appointment will be proposed with a member of our sales team, after which you will have direct online access to all information about our various open investment offers.

You can then invest in one or more Matis investment offers directly from your online space, after submitting your identity documents and completing an adequacy test. You can validate your investment order, and sign your subscription form.

Subscribing to a Matis investment offer results in the acquisition of convertible bonds into shares.

After your subscription, you will be regularly informed of news concerning your investment, on topics such as:

- the transportation and valuation of the work;

- the consignment date of the work to our partner galleries;

- the exhibition of the work at contemporary art fairs and other artistic events.

Once the work is resold, within a target horizon of two years, the invested amounts and the profit made on the resale of the work (not guaranteed) will be directly transferred to your bank account.

Investment in our investment offers is open to individuals or legal entities, French tax residents or not.

However, Matis reserves the right to decline certain subscriptions if customer due diligence or fund traceability requirements are not satisfactorily met, in accordance with regulatory obligations.

The simplified joint stock company holding the artwork issues convertible bonds into shares.

Matis uses a non-conversion premium mechanism to transfer the capital gain issued from the sale of the work by the holding to our investors, limiting the tax impact of this gain.

A stock setup would have been possible but would have led to a double taxation system that we wanted to avoid.

This structure has been reviewed and validated by a law firm advising us on the matter.

Matis is remunerated exclusively by its investor clients and only at the time of investment.

Each investment is subject to entry fees, divided as follows:

- 5% commission on the invested amount for the provision of order reception and transmission services

- 5% commission on the invested amount for the provision of investment services

In addition, Matis receives 20% of any profit generated on a investment offer, based on the performance achieved.

All Internal Rates of Return* (IRR) and target returns presented in our documentation are net of these fees.

*The Internal Rate of Return (IRR) measures the profitability of an investment over a given period. It takes into account the evolution of the value of shares and distributed capital gains over the period, as well as subscription and management fees supported by the investor.

Matis investment offers are available with a minimum investment of €20,000.

The convertible bonds into shares offered by Matis are subject to the tax regime of securities. Capital gains are thus subject to a flat tax of 30% for individuals, (17.2% in case of exemption), and taxed on corporate income tax or income tax in the case of certain subscriptions for civil companies choosing this tax regime.

These investments are not included in the taxable base of the IFI (French Wealth Tax).

.png)

.jpg)