Investing in art: which artist should you choose?

Investing in art is a culturally exciting and potentially lucrative form of investment. Over the past twenty years, this type of investment has attracted more and more amateurs and professionals. Like other types of investments in tangible assets, art has a strong emotional value linked to its physical reality and the pleasure of being able to appreciate it in museums, galleries, fairs, etc.

However, the art market may seem complex, opaque, or inaccessible to the uninitiated. So, how do you choose the right artists to invest and maximize your returns while trying to limit your risk? Which artists to bet on? How to select your artist (s)? Discover all our tips for investing in a work of art.

Summary

- Why invest in art?

- Criteria for choosing artists to invest in

- The artistic movements offering the most profitability

- The Essential Artists for Investment

- Artists Offering Significant Returns

- Best Practices for Investing in Art

- The Tools and Resources to Choose the Right Artists

Why invest in art?

Investing in art offers several advantages. First of all, it's A way to diversify your investment portfolio Or its heritage. Art, as an asset uncorrelated to the fluctuations of financial markets, offers investors protection in the face of economic crises. However, it is essential to focus on iconic works, especially those by recognized artists, who embody safe haven values for major collectors. Art also has an intrinsic value that can be appreciated over time. Especially in the case of institutional artists who are highly regarded and who gain recognition and prestige over the years.

Second, the art market is experiencing an almost constant growth in transactions. According to the Art Basel report, the art market reached $67.8 billion in 2022, an increase of 6% compared to the previous year followed by a decrease of 4% in 2023 (in comparison, the real estate market in France saw a 3-7% drop in the value of properties and a drop in transactions of 15% in 2023 compared to 2022). Despite the drop in value, the volume of transactions increased in 2023, reaching 39.4 million (an increase of 4% compared to 2022). This increase was driven by the resilience of transactions at lower prices, showing the dynamism and depth of the art market. These trends show that interest in art is constantly growing, making investments in this field more and more attractive. In addition, The art market generates an average annual return of around 7%.

Finally, the tangible and aesthetic aspect of art. Unlike stock market shares or the rents received by as part of a real estate investment, art can be appreciated visually and emotionally. Owning a piece of art means owning a piece of history and culture, which often brings personal satisfaction that other forms of investment cannot.

What are the criteria for choosing artists to invest in?

Investing in art requires having the right information and taking a thoughtful approach. Before getting started, it is crucial to get information and get expert advice. To get started, here are some general criteria to consider when choosing artists:

- The reputation and rating of the artist

Artists who are internationally recognized and whose works are exhibited in renowned museums and art galleries are usually excellent investments. Also, be sure to check the critical recognition and media coverage of the artists you are targeting.

- International Fame

The world of art is a particular world. The artist you are targeting as part of an investment must have been mentioned in specialized magazines (The Art Newspaper, Artforum, Art News, Apollo Magazine...) or must have been cited by internationally renowned experts or gallery owners. These same experts often set the tone for future ratings and the future trajectory of artists.

- Authenticity and origin

Another essential characteristic is the origin and the history of the work. A work with a clear and well-documented origin is more reliable and more valued. In addition, the authenticity of the work must be verified to avoid counterfeits and fakes.

- The artistic period

When talking about investment, it is possible to categorize works of art into three main types: ancient art, impressionist and modern art, and contemporary art. However, these types of art do not offer the same returns and do not have the same investment characteristics. There are three main categories:

- Ancient art. This market is characterized by a large volume of works traded at low values. For their part, the majority of major works have already joined museum collections. In addition, the difficulties associated with the authenticity of works make them a market that is not well suited to investment.

- Modern and Impressionist Art. The works still available on the market are difficult to buy and sell, and are therefore only accessible to a clientele of privileged collectors, which makes this market undemocratic and not very accessible.

- Contemporary art. It is the most democratic segment of the art market: the prices of works range from tens or hundreds of euros to more than 200 million euros. It is the market where there is the most volume and sales value, and where the growth is the strongest.

The Essential Artists for an Investment

Investing in a little-known artist often makes you want to. It is said that rarity and unknown character guarantee high returns. However, the first steps of investing in art deserve to be supported, and even guided.

For a first investment, it is therefore preferable to invest in established artists because of the demand for their works of art, their prestige or their presence in the permanent collections of the largest international museums. These artists, who are called Entertainers Blue Chips, embody certain values in the art world. Here are some of them listed below and organized by movement.

Modern artists

Modern artists include:

- Vincent van Gogh

- Pablo Picasso

- Claude Monet

- Henri Matisse

- Paul Cézanne

- Gustav Klimt

- Wassily Kandinsky

- Edvard Munch

- Amedeo Modigliani

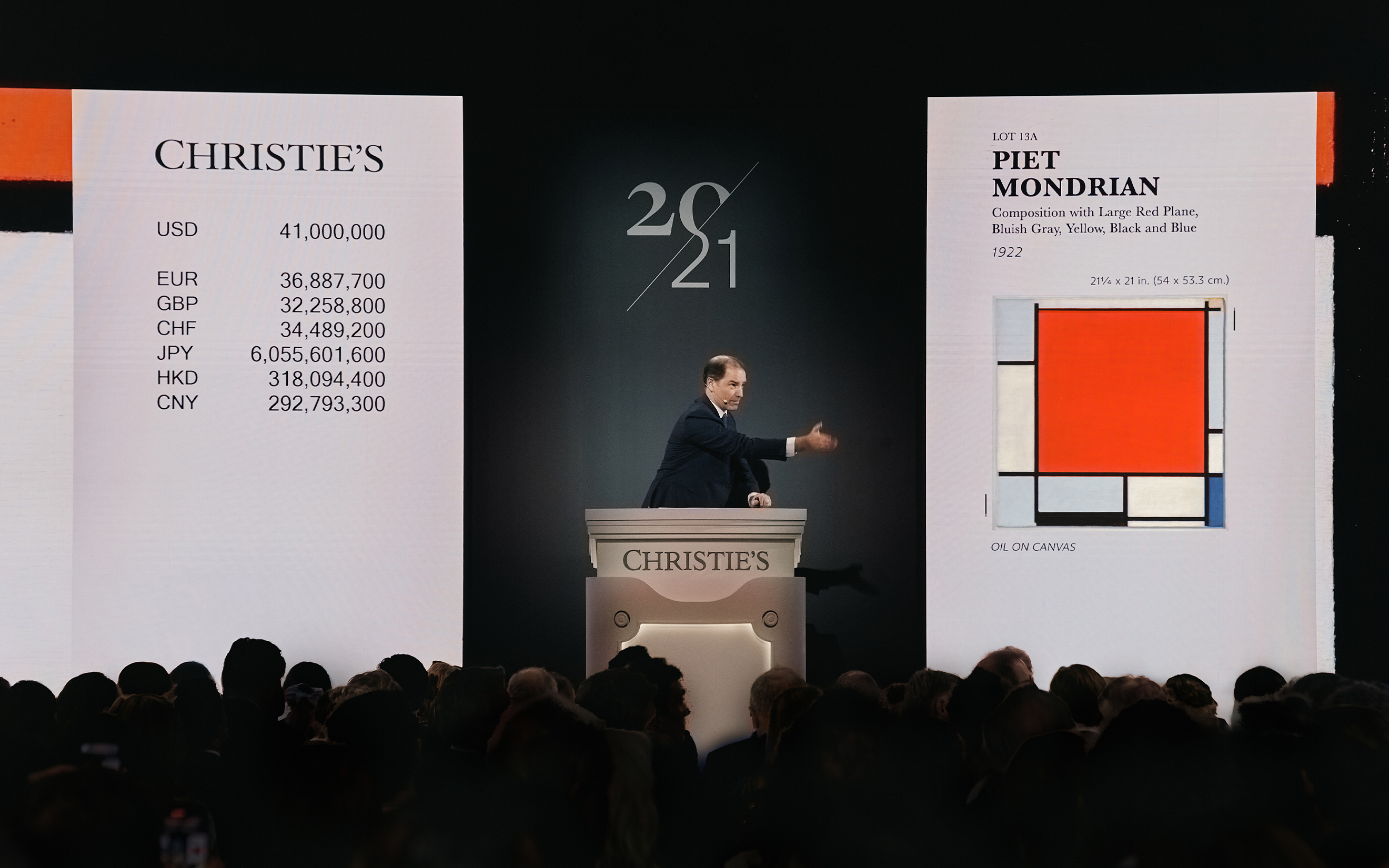

- Piet Mondrian

- Georges Braque

- Marc Chagall

- Fernand Léger

- Joan Miró

Contemporary artists

Contemporary artists include:

- Jeff Koons

- Andy Warhol

- Claude Lalanne

- Alexander Calder

- Lucio Fontana

- Pierre Soulages

- Yayoi Kusama

- David Hockney

- Keith Haring

- Gerhard Richter

- François Xavier Lalanne

For example, Matis has made several sales on works by established and recognized artists from these key periods in the history of art:

Disclaimer : Past performance is not indicative of future results. Investing in unlisted assets carries the risk of partial or total loss of the invested capital.

Emerging artists

Investing in emerging artists can be an exciting and fulfilling idea. However, some risks associated with these investments exist and there are a few prerequisites to know before starting:

- Know the origin, training, influences and career of the artist;

- Check which museums and galleries the artist has exhibited in;

- Read expert reviews and reviews about this artist;

- If possible, find out about the relationships he maintains with gallery owners and museums.

- Plan for the duration of ownership of important works (more than 10 years)

Among the artists considered to be “emerging”, we can cite Tschabalala Self, Amoako Boafo, Jade Fadojutimi, Salman Toor, Shara Hughes, Harold Ancart, Harold Ancart, Harold Ancart, Harold Ancart, Harold Ancart, Harold Ancart, Harold Ancart, Harold Ancart, Harold Ancart, Harold Ancart, Loie Hollowell or even Jordan Casteel. Marketplaces like Artsper gold Singulart Allow you to buy works or editions by these artists. However, while the artists mentioned above are mostly fairly established artists, these platforms nevertheless allow you to buy works from other artists who are even more “emerging.”

The Artists Offering the Most Attractive Returns

Among artists who offer significant returns, it may be useful to refer to The Artprice 100© Index To worry. This index, created in 1997 by an art market listing company, takes a fictional stake in the top 100 artists at public auctions at the beginning of each year, not only in terms of sales revenue but also in terms of liquidity. The weight of each of them is adjusted in proportion to the turnover they generated during these previous five years. At the end of the year, the index makes it possible to visualize the theoretical increase in value for each artist based on the evolution of the price index.

Here are the top 10 established in 2023 along with their theoretical increase in value:

- Pablo Picasso (modern art): 8.3%

- Andy Warhol (post-war art): 5.1%

- Claude Monet (19th century): 5.0%

- Jean-Michel Basquiat (contemporary art): 3.9%

- Zao Wou-Ki (post-war art): 3.4%

- Gerhard Richter (post-war art): 2.8%

- David Hockney (post-war art): 2.4%

- Yayoi Kusama (post-war art): 2.1%

- René Magritte (modern art): 2.1%

- Qi Baishi (modern art): 2.0%

Si Matis has launched several club deals around prestigious and recognized artists, investors report an easy and pleasant experience. Romain Suaudeau, tech company manager, explains:”Matis allows you to invest in a piece of art history. [...] I was able to easily invest in a successful asset class, which is difficult to access directly, without extensive knowledge of the art market and without a significant financial envelope.” Same goes for Ivan Michal, a partner in a private equity fund:”As a personal collector, I was seduced by Matis's value proposition, which allows me to understand art from a new angle, that of investment. Matis's selection strategy, which focuses only on world-renowned artists whose popularity has been established for years, convinced me to take the plunge.”

The tools and resources to invest in art

In addition to the research, advice or support that you can get from an expert, we also recommend using specialized platforms — in particular to follow art market trends and artist ratings.

Online platforms

Here are the names of some reference platforms that can serve as solid bases on which to learn:

- Artsy;

- Net money;

- Artprice;

- MutualArt;

- Art Market Monitor (AMM);

- Sotheby's, Christie's;

- Artifacts;

- ArtTactic;

- Widewalls;

- Art Basel;

Books and magazines

It may also be interesting to explore books written by collectors, experts, or authoritative gallery owners in the field of art investing, here are a few:

- The Art Basel & UBS annual report;

- ”Fine Art and High Financeby Clare McAndrew;

- ”Leo Castelli and his family”, by Annie Cohen-Solal;

- ”The Artist, the Institution, and the Market”, by Raymonde Moulin;

- ”The world of galleries. Contemporary art, market structure and internationalization”, by Alain Quemin

- ”Art as an Investment?“, by Melanie Gerlis;

- ”Art and Finance Report“by Deloitte and ArtTactic.

Experts and specialists

Finally, it is obviously possible (and even recommended) to have recourse to experts or advisers specialized in art investment. You can also contact the experts at Matis who are at your disposal. Indeed, the selection of artists is the core business and expertise of Matis. With the help of our team and our collaborators with solid experience in the field of art, we will obviously be in a position to answer all your questions.

To sum up, before you start investing in art, here are our five tips to keep in mind:

- Analyze the career and trajectory of the artist you are targeting;

- Learn about the context and trends of the art market;

- Learn more through online resources, specialized platforms, or experts;

- Ensure the quality and authenticity of the work of art;

- Analyze your own financial situation and consider this investment as an opportunity to diversify your wealth.

.png)

.jpg)