Investment Perspectives for 2024: Identifying the Most Promising Opportunities

The new year offers a chance to review the performance of last year's investments and consider whether to adjust your strategy or make some tweaks for upcoming investments. Aiming to meet every need, whether it’s adjusting allocation to market contexts, diversifying, securing assets, or seeking higher returns, this article explores various investment avenues for 2024 in a non-exhaustive manner.

1. Understanding Investment in 2024

Where to Invest in 2024?

Investing in areas like renewable energies, technology, and healthcare could offer significant growth opportunities. For those looking to bet on the economic context or protect against it, Ray Dalio's all-weather portfolio approach establishes asset classes that rise or fall based on two parameters: inflation and growth.

Which Sector to Invest in for 2024?

Within these asset classes, themes such as renewable energies, artificial intelligence, and healthcare can be promising. These trends or mega-trends allow exposure to long-term tendencies, avoiding the whims of market cycles.

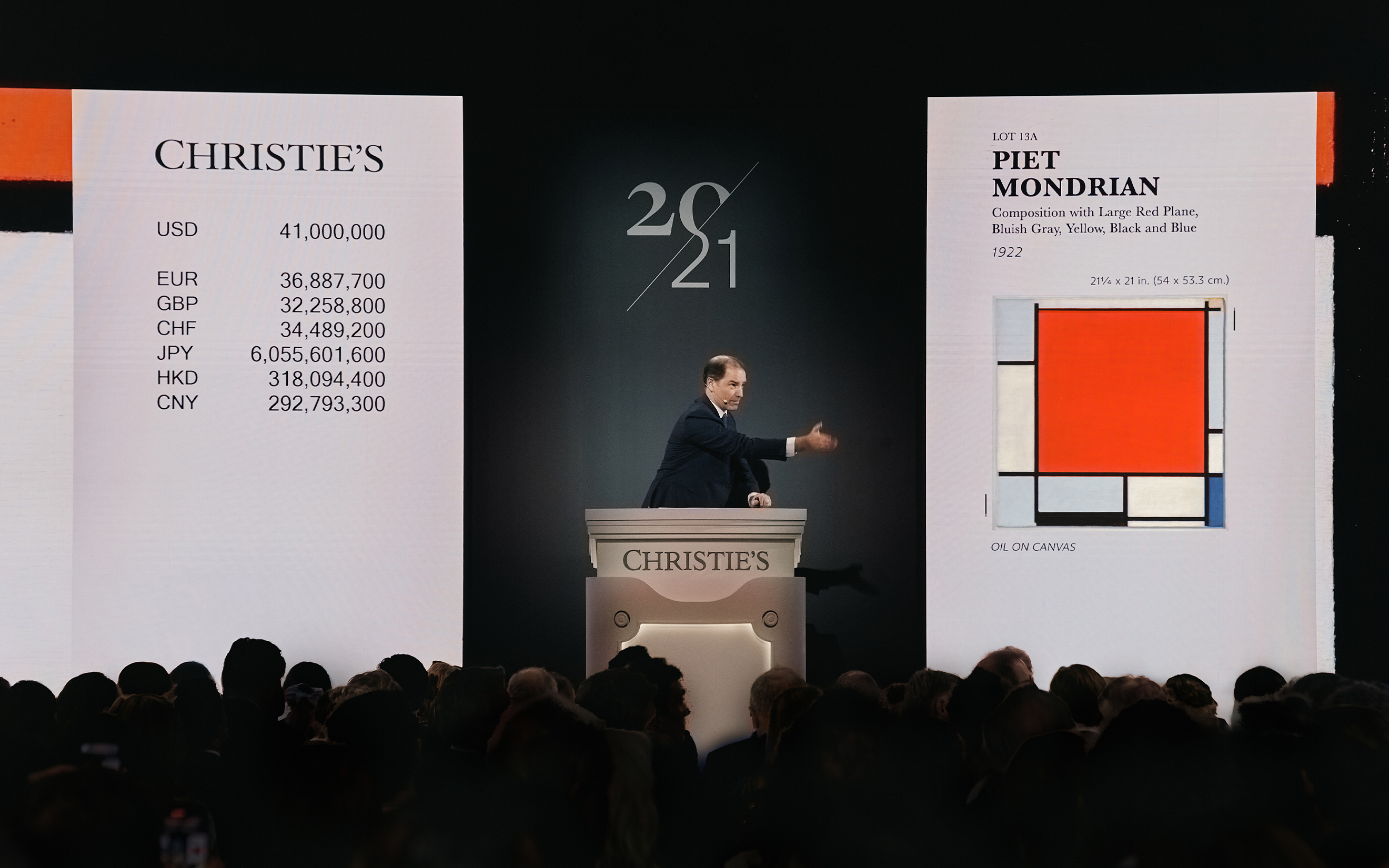

Alternative and uncorrelated asset classes, like art, private equity, and commodities, may also present interesting opportunities. Check out our dedicated article on alternative investments for more insights.

What Investment Yields Monthly Returns?

Considering investments, managing liquidity and distribution is also important. What proportion are you prepared to wait for years to realize a capital gain without intermediate income? How much do you want to allocate to investments that regularly generate income (dividends, rents, coupons)? Investments that can yield monthly returns include dividend stocks, government or corporate bonds with regular coupons, or rental real estate. Always focus on the underlying asset's dynamics, keeping in mind that an investment generating regular income will often have less capital gain upon resale compared to capitalization assets that pay little or no intermediate income.

2. Types of Investments to Consider

Best Investment for Making Money

The tendency to relentlessly seek the best investment options at all costs is a trap to avoid, as the criteria for selecting an investment depend on individual needs (income or capitalization, protection or performance, short-term or long-term, liquid or fixed, etc.).

If there were an investment that consistently outperformed others on all criteria over the years, regardless of market context, it would be a secret hard to keep. Benjamin Graham's "The Intelligent Investor," a guiding text for Warren Buffett in investment matters, stands as one of the finest books for a rational approach to investing.

However, it's feasible to select specific themes and work with expert investment teams capable of delivering impressive performances in their areas of expertise.

Indeed, one of the best ways to approach investments for regular monetary gains while minimizing risks is to diversify across assets with differing dynamics or correlations. This strategy is one of the most effective for harnessing the performance of each asset and using diversification as a tool to limit overall risk. A well-written article by Carmignac, for instance, delves into the concepts of correlation and diversification in investments.

Most Profitable Investment in the World

Historically, certain investments have provided exceptional returns. While real estate and stock markets remain profitability staples, innovative sectors like green technology and cryptocurrencies have shown substantial gains over certain periods. However, it's vital to approach these markets with deep understanding and a well-thought-out risk strategy.

Stocks That May Rise in 2024

Investing in stocks requires ongoing analysis of market trends and company performance. In 2024, look for companies well-positioned to capitalize on emerging technologies, demographic shifts, or infrastructure needs. Companies innovating in areas such as renewable energy, the Internet of Things, or digital health could be particularly attractive candidates. However, these primarily represent long-term trends. For shorter term (and thus riskier) bets, it's essential to consider how different industries evolve according to economic cycles and to speculate on the economic cycle we are entering. A very informative article has been written on this topic by Etoro Academy detailing the impact of economic cycles on stock market sectors, and Morningstar offers insights on where to invest during a recession.

Real Estate Investment in 2024

Real estate remains a reliable and potentially profitable investment sector. Trends to watch in 2024 include urban development, changes in housing preferences, and the impact of technology on property management. Investments in growing areas or in properties with strong potential for appreciation can offer significant returns. To stay informed about the dynamics of real estate markets, it is recommended to subscribe to the excellent Real Estech newsletter led by Robin Rivaton and Vincent Pavanello.

Alternative Assets

Alternative asset classes are essential for "Ultra High Net Worth" individuals (those with a net wealth of over 30 million euros). These assets can make up to 50% of such portfolios, compared to about 5% for an average investor. The eight major families of alternative assets include:

- Private equity (investment in non-listed companies);

- Private debt (loans to non-listed companies);

- Hedge funds;

- Real estate;

- Commodities;

- Collectibles (with art being a significant part);

- Structured products;

- Cryptocurrencies.

These assets have their own dynamics and are increasingly considered by investors as they can generate performance and complement traditional stocks and bonds. Read our article "Everything You Need to Know About Alternative Investment" to learn more about these options.

3. Investment Strategies and Considerations

Profitable Short-Term Investment

Some investors may prefer short-term strategies to capitalize on rapid market movements. This can include trading stocks, options, or investing in highly volatile cryptocurrencies. While these methods can offer quick returns, they also involve high risk and require constant market monitoring without a guarantee of success.

Investing in the Stock Market in 2024

The stock market remains an essential area of investment. In 2024, staying informed about economic fluctuations, government policies, and sector innovations will be key. Investing in index funds, individual stocks, or ETFs can provide exposure to various sectors and regions while diversifying risk.

Real Estate and SCPI

Real estate and Sociétés Civiles de Placement Immobilier (SCPI) offer interesting investment methods, sometimes with associated tax benefits (such as LMNP) and the possibility of obtaining bank leverage and/or regular income. These vehicles can be particularly attractive for those looking to invest with a long-term vision and a more conservative approach. However, the current context of redefining prices in a changing interest rate environment, where credits are harder to obtain and prices have not yet decreased in proportion to the economic context, should be considered. The logic here would be to aim for the long term.

Conclusion

In 2024, investment options are as diverse and dynamic as ever, especially with trends that simplify access to previously less accessible assets like private equity or art. Whether it's stocks, real estate, SCPI, or emerging sectors, a balanced and informed approach is crucial. By staying up-to-date with market trends, diversifying your investments, and avoiding common mistakes, you can tailor your portfolio to underlying trends.

Image credit : Auctioneer Matthieu Fournier sells Chardin's Panier de fraises for the record sum of 24.4 million euros on March 23, 2022.© Artcurial

.png)

.jpg)